The Hindu: Kerala:Monday, February 2017.

Banks yet to get mandatory clearance from Competition Commission of India

The merger of State Bank of India with its associate banks, including the State Bank of Travancore (SBT), is likely to be delayed further as these banks are yet to get the mandatory clearance from the Competition Commission of India (CCI).

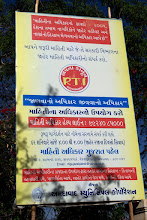

The Union Cabinet had given its approval for the merger on Wednesday last. However, information sought under the Right to Information Act (RTI) says that these banks have not yet received any clearance from the CCI.

“The commission has not given permission for the takeover of subsidiary banks — State Bank of Travancore, State Bank of Mysore, State Bank of Patiala, State Bank of Hyderabad, and State Bank of Bikaner & Jaipur,” the CCI stated in its reply to a query.

It also said that these “five subsidiary banks have not sought permission from the CCI either individually or collectively for the takeover.”

To another query, the CCI clarified that the Union government on January 8, 2013, had exempted such banking company in respect of which the Centre had issued notifications under Section 45 of the Banking Regulation (BR) Act 1949 from the application of the provisions of Section 5 and 6 of the Act in public interest. That means, since the acquisition of the associate banks is being done under Section 35 of the SBI Act, these banks have not been exempted from the Competition Act.

Section 45 of the BR Act is pertaining to banks which were declared moratorium by the Reserve Bank of India (RBI).

However, in the draft Scheme of Acquisition of Associate Banks by the SBI, it has been stated that the acquisition has been exempted from the Competition Act. The petitioners had challenged this contention and had filed complaint before the CCI.

In their complaint, the petitioners argued that the proposed merger of SBT and other four associate banks were in violation of the Competition Act 2002 in letter and spirit, and purpose and intent in that the proposal was for creating monopoly and destroying competition.

It said the merger would adversely impact fair competition among banks and the SBI was abusing its dominant position in imposing the proposed merger over the SBT and other associate banks. Further the SBI is proposing to enter into a combination that would cause an appreciable adverse effect on competition.

The petitioners also stated that the merger move was illogical as these banks were in existence for very long in various States, with sound financial fundamentals, commendable financial ratios, well-established network of branches, and serving the people at large in rural, semi-urban, and urban centres.