Business Standard:

Mumbai: Monday, March 31, 2014.

The Right to

Information (RTI) Act was implemented in India nine years ago. The Bill was

introduced in 2004's winter session of Parliament and passed in June 2005.

RTI remains a

potent legal weapon to fight opacity in public offices and politicians continue

to fear it. In the last winter session, a Parliamentary standing committee,

while supporting passage of an amendment in the Act, concluded political

parties should be kept out of the ambit. The RTI (Amendment) Bill, 2013, seeks

to insert an explanation in Section 2, which states any association or body of

individuals registered or recognised as a political party under the

Representation of the People Act, 1951, will not be considered a public

authority.

While many

people have successfully used RTI to get information on their applications for

ration cards or passports, there are mixed views on what extent RTI can benefit

a layman.

Individuals

face many issues with money matters. How can investors make the best use of

RTI? Says Pune-based RTI activist Vivek Velankar: "On the investment side,

there are many private sector companies. Unfortunately, they do not fall under

the purview of RTI directly. Only public sector companies come under it."

Private companies can be tracked under RTI through the regulators like Reserve

Bank of India (RBI), Securities and Exchange Board of India (Sebi), and

Insurance Regulatory and Development Authority of India (Irda).

Regulators

can provide only the information a company is bound to furnish. At the same

time, not all this information can be shared with you. The Act, under Sections

8 and 9, exempts certain categories of information from disclosures.

The fee for

an RTI application to a central government authority is Rs 10, to be paid

through demand draft or cheque or by post. The charge for providing the

information is Rs 2 for each page created/copied, actual charge of a larger

size paper copy, actual cost for samples and, for inspection of records, no fee

for the first hour, Rs 5 for each 15 minutes, thereafter. To provide

information under Section 7(5) of the Act, it will charge Rs 50 per diskette or

floppy. For information provided in printed form at the price fixed for such

publication or Rs 2 per page of photocopy for extracts from the publication. If

a financial institution or a regulator can provide the required information, it

will do so within 30 days of receiving the application.

Here's how

you can use RTI with various financial institutions:

EPF: There

have been many instances of employers not depositing the contributions towards

Employee Provident Fund (EPF) deducted from an employee's salary. Employees can

file an RTI application with the Employee Provident Fund Organisation (EPFO) to

check. An EPF account balance can be checked online.

Those who

have transferred EPF balances know the pain of doing so. It is hard to track

the balance transfers. RTI can help in checking the status. Even withdrawals

from an EPF account can be tracked through RTI.

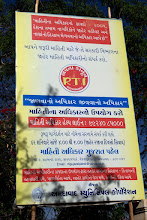

Real estate:

RTI activist Bhaskar Prabhu of Mumbai's Mahiti Adhikar Manch says individuals

looking to buy a house in a realty project can use RTI. Eighty per cent of

Mumbai flats do not have an Occupation Certificate (OC), without which you cannot

enter a flat. "Individuals can ask for the Information of Disapproval

(IoD), under which one can know the requisites the builder needs for the

project, which of the documents he has, which ones are yet to be furnished, if

the permission from local authority is in place, if the project is in the

builder's name or not, if the land title is clear or not, floor planning of the

construction, fire safety planning and so on," he says.

Here, you

will need to check with the local authority under which the project falls -

municipal corporation, collector, gram panchayat. Accordingly, the RTI

application should be addressed, says Prabhu.

Banks:

Sometimes, bank staff can be non-cooperative. If you feel so, RTI can help you

secure information about customer service norms, its service and the terms and

conditions.

Second, banks

might allow you to open an account or locker only if you make a deposit or buy

a insurance policy. You can question banks on such unjust rules. Or, when you

think a bank has gone against its own terms and conditions. Assume you are

shopping for the cheapest home loan and a bank is not helping with the required

information. You can find the interest rates, prepayment norms and other

documentation issues through RTI.

However, this

is only applicable to nationalised banks directly. For private sector banks, go

through RBI.

Insurance:

There are only five public sector insurance companies - Life Insurance

Corporation of India (LIC), New India Assurance, United India Insurance,

Oriental India Insurance and National Insurance. These can be approached

directly; the private insurers will have to be approached through Irda.

"There

isn't exact transparency on where traditional insurance plans invest.

Policyholders can question LIC on that," says Velankar. You can also check

on the charges of investing in traditional and unit-linked plans. Claim status

can also be checked, if delayed.

Most banks

are listed and declare financial details. So do even the unlisted insurance

companies, through their bank promoters. You can ask for more financial details

from these institutions, if required.

Income tax:

According to experts, if all the information provided while filing the return

was correct, and the refund hasn't come, one can check the status with an RTI

application. Only an assessee can make an application for knowing the status of

his/her tax income tax refund.

Experts

suggest this route if you have not received your refund for at least a year.

RTI is an interim step before you knock at the Ombudsman's door.